Getting the right Forex broker for your trading ventures isn’t always straightforward as it may seem. There are lots and lots of variables you need to account for to pick one that not only maximizes your profitability in the market but also protects your safety at all times.

So, how do you find one exactly? The first thing you need to ensure is the broker’s safety. You should definitely check out its license and determine how trustworthy it is. There are way too many fraudulent brokers with shady licenses for you to trust their regulatory claims blindly.

On top of that, you also need a broker that offers many different instruments, as well as low commissions and profitable trading features. It goes without saying that a good brokerage is all about combining these two aspects – safety and profitability.

The following review of Exness Forex broker will show you just how well it manages to combine these two aspects into one trading platform. So, let’s not waste any of your and our time and get straight to the review.

At a glance

Exness is a Forex trading brokerage established 12 years ago in Cyprus. And as a Cyprus-based brokerage, it owns a financial license from the country’s main regulator. But it’s hardly the only institution monitoring Exness’ activities: The broker also owns a license from the UK and Seychelles regulators.

.

Coupled with these top-tier safety measures, Exness’ platform comes with profitable trading terms and conditions too. There are, in total, 150+ different financial instruments you can trade, which range from currencies all the way to cryptocurrencies.

And the features that accompany these instruments are also very beneficial to your trading success. First off, Exness features very low and competitive commissions on them, not to mention spreads that go as low as 0 pips. And then there’s unlimited leverage, which we’ll discuss in detail further down below.

In short, our Exness broker review demonstrates how great of a service provider it actually is.

Exness’ products and their features

Arguably the most sought-after broker feature traders are interested in is its trading instruments and their terms and conditions. After all, you want to be as profitable in the market as possible, right?

So, how does Exness fare in this sense? Well, as it turns out from our in-depth review, the broker offers you more than 150 different financial assets to trade. These assets range in the following classes:

- 107 currency pairs

- 40 stocks and indices

- 12 metals and energies

- 7 cryptocurrencies

The diversity in this section not only lets you trade all sorts of different assets individually and test out whose characteristics work best for you, but also invest in them simultaneously: this helps you to diversify your portfolio and render it more stable against unexpected market occurrences.

But that’s hardly the only benefit we found in our Exness review. On the broker’s website, we found that the maximum leverage isn’t specified at all. What it means is that you can apply 1:unlimited leverage to your positions, which is a feature you can rarely find with a Forex broker.

Now, we have to note that not all positions can get a 1:unlimited leverage rate. Exness has a pretty comprehensive table where it lists the position sizes with their compatible leverage ratios, where:

- From 0 to 999 position sizes – 1:Unlimited

- From 1,000 to 2,999 position sizes – 1:2000

- From 3,000 to 9,999 position sizes – 1:1000

- From 10,000 to 19,999 position sizes – 1:600

- From 20,000 to 49,999 position sizes – 1:400

- From 50,000 to 199,999 position sizes – 1:200

- From 200,000 to more – 1:100

As you can already tell, these varying leverage rates target traders with different backgrounds. For instance, entry-level traders won’t be able to deposit hundreds of thousands of dollars to open regular positions, which is why Exness offers them a higher leverage ratio than on higher levels.

Therefore, the following review of Exness Forex broker shows that trading opportunities are pretty lucrative on this platform.

Commission rates on Exness’ platform

Another important trading feature you need to know about is the broker’s commission levels. On the one hand, you want to do business with a broker that doesn’t eat too much into your profits, while on the other hand, you still want a responsible and transparent broker; one that openly tells you which commissions it charges.

At Exness, you can find exactly that combination. Let’s take a look at both trading and non-trading fees of the broker.

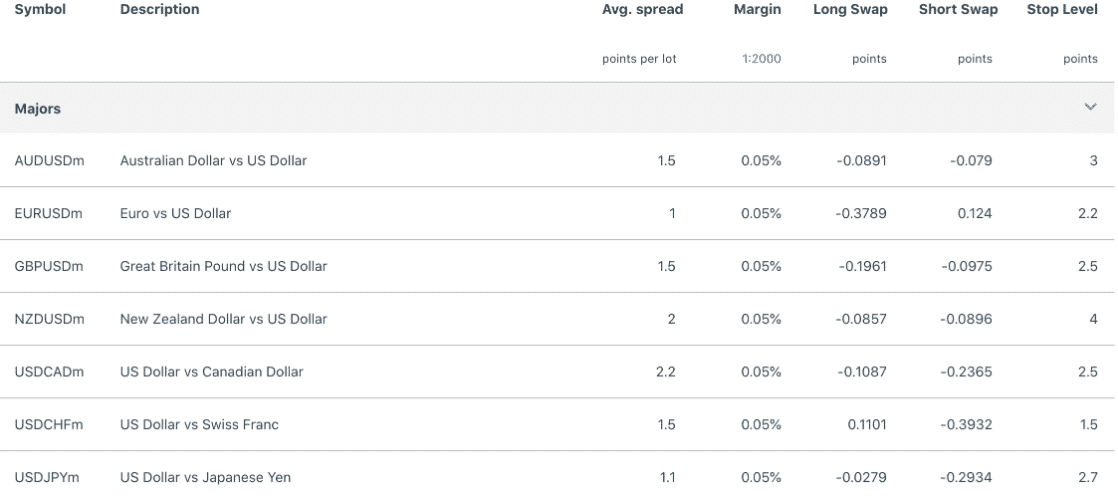

Trading fees

When choosing any of the available financial instruments to trade with Exness, you’re not charged a single buck for it. In fact, this condition is visible across the board, regardless of whether you’re trading currencies, stocks, or even cryptocurrencies.

What we found during our Exness review is that there are some accounts that come with a commission rate. For instance, if you go for a Raw Spread or a Zero account, you’re either going to get less than 5USD or more than 5USD commission, but even the latter one is an affordable choice when compared to other brokers.

Another important trading fee, and the one that Exness depends on massively, is a bid/ask spread. It’s mainly charged for trading Forex, and the minimum spread markup you’re getting with this broker goes all the way down to 0 pips. Regularly, the EUR/USD pair at Exness gets a 1-pip charge, which is still a very beneficial condition.

The last trading-related fee we need to talk about is an overnight swap. If you want to trade Forex and leave your position open for longer than a day, you’ll get an interest rate charge overnight. But as our Exness broker review indicates, even these swaps are getting pretty competitive conditions on this platform.

Non-trading fees

Now, when it comes to non-trading fees, Exness goes the extra mile to make your experience even more beneficial. It completely eliminates deposit and withdrawal fees, as well as an inactivity fee.

Thus, the overall package of Exness works entirely to your advantage.

The company background and regulation

While trading terms and conditions are usually the main aspects of the broker traders look for, you have to keep in mind that your financial safety should always come first. Your broker may be offering you the lowest commission rates and the highest leverage levels with its security measures completely neglected. This can easily lead you to insurmountable losses – something you definitely don’t want to encounter during your trading ventures.

With Exness, you don’t have to choose safety over profitability. As we’ve already seen so far in our review of Exness Forex broker, its trading features are some of the most lucrative ones in the market. And safety features are no less impressive either.

First, let’s start with its regulation. In the Regulation section of its website, Exness lists three different financial licenses from three different regulators, namely:

- Cyprus Securities and Exchange Commission (CySEC)

- Seychelles Financial Services Authority (FSA)

- Financial Conduct Authority (FCA) of the UK

Now, two of these licenses – CySEC and FCA – come from some of the most highly-regarded Forex regulators in this industry. Both Cyprus and the United Kingdom are powerful economies with strong regulatory oversight of not only local brokers but also those that operate internationally.

And while the FSA license from Seychelles is dwarfed by those two, we’re still glad to see it on this platform. It adds additional assurance to your choice and gives you peace of mind about the trustworthiness of this broker.

On top of all this, our Exness review also shows that the broker features three different fund protection mechanisms on its platform. These include:

- Negative balance protection – Assurance that should your leveraged position run out of the entire account balance and starts to get into the negative area, it’ll automatically be closed;

- Account segregation – Policy that demands your deposits and profits be stored on separate bank accounts, which protects them from being abused by the broker;

- Customer compensation fund – Fund pool that always has an emergency capital for compensating Exness’ clients should the broker go bankrupt or something similar happen to it.

All in all, it’s pretty obvious that not only does Exness care about your profitability in the market but it also ensures the safest trading experience for you.

Can you get bonuses at Exness?

During the course of this review, we also wanted to find whether Exness has any bonus offerings or other types of promotions available on its website. Over time, promotions have taken a pretty significant place in the trading market, and brokers often use them to increase their appeal to new and existing clients.

However, as shown in our Exness broker review, there are no bonuses to be found on this platform. And it’s not surprising at all: Exness features two Tier-1 licenses from Europe – the CySEC and FCA -, both of which fall into the MiFID regulation. And the latter is known for its prohibition of bonus promotions.

The reason why these regulators oppose bonuses is that without them, brokers have to focus on their actual trading and safety features to appeal to the clients. This, in turn, takes the entire trading platform to a whole new level without the need for superficial promotions, and that’s exactly why Exness is a trustworthy broker.

Signing up for Exness

Are you convinced about Exness’ advantages already? Good, because now, we’re going to take a look at how you can sign up for it and which accounts you can get.

The registration process is actually pretty simple and quick. During this review of Exness Forex broker, our reviewers managed to create a live trading account with just these simple steps:

- Fill in your personal details like your full name, country of residence, date of birth, email address, and employment details.

- Verify that information by uploading your Identification Card/Passport/Driver’s license and utility bill/bank statement for identity and residential address verification.

- Make a deposit on your newly-created account.

- Start trading.

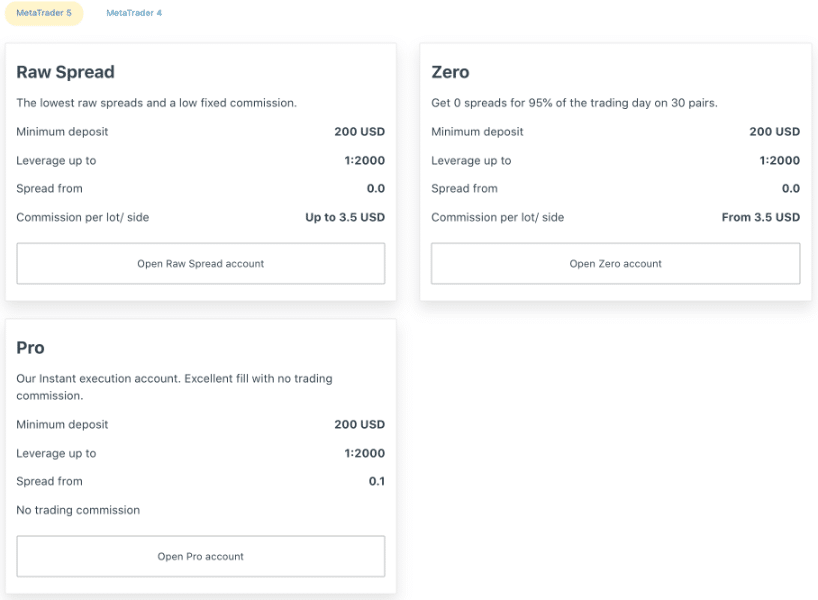

And that’s it; in just these steps, you can get yourself a fully-functional trading account at Exness. And if you’re wondering which trading accounts you can get with this broker, you’re in for a great choice:

- Standard account – 1 USD min. deposit; 1:2000 leverage; 0.3 pips for spreads.

- Standard MT4 account – 1 USD min. deposit; 1:unlimited leverage; 0.3 pips for spreads.

- Standard Cent MT4 account – 1 USD min. deposit; 1:unlimited leverage; 0.3 pips for spreads.

- Raw Spread account – 200 USD min. deposit; 1:2000 leverage (1:unlimited for MT4); 0 pips for spreads.

- Zero account – 200 USD min. deposit; 1:2000 leverage (1:unlimited for MT4); 0 pips for spreads.

- Pro account – 200 USD min. deposit; 1:2000 leverage (1:unlimited for MT4); from 0.1 pips for spreads.

As you can see from our Exness review of the accounts, there are quite a few package options you can go for. And, what’s more, you can even get a swap-free “Islamic” account for the following accounts: Standard, Standard Cent, Pro, Zero, and Raw Spread.

And to top it off, Exness also features an unlimited demo account on its website. With this account, you can trade just about any financial instrument virtually without making deposits and losing money. This is a great tool for beginners who want to hone their trading skills, as well as more experienced ones who are transitioning from one market/strategy to another.

How to make deposits and withdrawals at Exness

Beneficial trading terms and conditions don’t end with just trading accounts, leverage, and commission rates; there are much more than that with Exness. And among them, we can definitely consider deposit and withdrawal methods.

On the website, you can find a very comprehensive list of payment options ranging from traditional banking methods all the way to alternative e-wallets and even cryptocurrencies. Here’s all of those methods with their conditions found during our Exness broker review:

- Qiwi – 1 USD min. deposit; Instant deposits; Instant withdrawals.

- Internet-bank “Promsvyazbank” – 1 USD min. deposit; Instant deposits; No withdrawals.

- Internet-bank “Alfa-Click” – 1 USD min. deposit; Instant deposits; No withdrawals.

- Bitcoin – 0 USD min. deposit; Deposits up to 4 hours; Withdrawals up to 72 hours.

- Tether (USDT) – 1 USD min. deposit; Deposits up to 72 hours; Withdrawals up to 72 hours.

- Bank Card (Visa, Mastercard) – 3 USD min. deposit; Instant deposits; Withdrawals up to 3-5 days.

- Neteller – 10 USD min. deposit; Instant deposits; Instant withdrawals.

- Yandex Money – 1 USD min. deposit; Instant deposits; Withdrawals within 24 hours.

- Perfect Money – 50 USD min. deposit; Instant deposits; Instant withdrawals.

- WebMoney – 1 USD min. deposit; Instant deposits; Instant withdrawals.

- Skrill – 10 USD min. deposit; Instant deposits; Instant withdrawals.

- Internal Transfer – 1 USD min. deposit; Instant deposits; Instant withdrawals.

As you can see, both deposits and withdrawals at Exness come with very beneficial terms and conditions. During our review of Exness Forex broker, we made both of these transaction types and got exactly the same execution times as listed above.

Moreover, Exness eliminates all deposit/withdrawal commissions for your better convenience. This ensures that you’re getting exactly the same amount of money you’ve originally deposited or withdrawn. A quick disclaimer: some third-party providers may still charge you some fees from their part, but Exness won’t have anything to do with those charges.

Which platforms can you get at Exness?

One of the main missions of a Forex broker is to provide you with a full-fledged platform that powers all your trading ventures. It should be filled with various charting mechanisms, as well as technical indicators and other research objects, not to mention portion measures like stop-loss and take-profit.

In the following Exness review, we discovered three different trading platforms you can choose from, namely:

- MetaTrader 4

- MetaTrader 5

- WebTerminal

Let’s take a look at each of them and see how they approach trading.

MetaTrader 4

MetaTrader 4 is by far the world’s most actively-used platform, and it’s been so for at least a decade now. With its flexible trading features and analytical objects, MT4 helps you take your trading game to the next level, and that’s also visible at Exness.

Here, MT4 comes with 30 different technical indicators, as well as 23 other analytical objects. The software supports two top-notch execution modes: Instant and Market, and you can even use Expert Advisor robots to automate your positions.

And all that is compounded even more by the 128-bit key encryption, which ensures the safest trading experience for you.

MetaTrader 5

Similarly to its older brother, MetaTrader 5 is also a very popular platform in the trading community. And while the design and some fundamental features are pretty much the same in both platforms, our Exness broker review shows that there are definitely features that definitely set MT5 apart from other platforms, not just MT4. For instance, it can accommodate a much larger number of financial instruments than MetaTrader 4. Besides, it also comes equipped with an economic calendar, an autochartist, and many other high-powered trading features.

WebTerminal

If you want a bit more convenience and avoid any download and installation hassle, you can easily go for Exness’ WebTerminal, which is available for pretty much all popular web browsers like Google Chrome, Safari, Firefox, or Opera. It lets you conduct both technical and fundamental analysis, comes with a simpler interface, and offers real-time quotes.

Trading education at Exness

As a properly-regulated Forex broker, Exness also cares a lot about your trading education. This is why it features a pretty extensive educational section filled with engaging materials ranging from articles all the way to online courses.

Here are the educational materials found in our review of Exness Forex broker:

- Trading Academy

- Insights and analysis articles

- News from markets

- Webinars

- Glossary

A great advantage of Exness’ educational section is that not only is it done very professionally, but it’s also available for free. You’re not required to set up a trading account with the broker to start educating yourself in Forex; if you want an article or a webinar to find out more about trading, you’re free to use it.

Plus, all of these materials are available on both desktop and mobile devices for better flexibility.

Exness’ customer support

One of the integral elements of decent customer experience is properly-functioning customer support. Your broker should have various ways of interacting with its clients and providing them with helpful information about trading in general, as well as its platforms more specifically.

As shown during our Exness review, customer support is definitely regarded as an important part of the experience. This is why the broker offers you a number of different ways to communicate with it, including:

- Email support: support@exness.com

- Live chat on the website

Both of these methods are extremely fast, as well as informative, and can help you a great deal. But Exness also has an extensive FAQ section, which is filled with informative answers about all sorts of different questions. And, once again, this section is accessible via desktop and mobile devices alike.

Trading with Exness – Is it worth it?

After a lengthy discussion about the broker and its various features, how can we rate Exness? Is it worth trading with it over an extended period of time?

As we have found during our Exness broker review, the platform is monitored by three different financial regulators from three countries: Cyprus, the UK, and Seychelles. These regulators ensure that Exness doesn’t engage in fraudulent activities and that it remains honest with its offerings all the time.

Along with safety, Exness also cares about your profitability in the market. It provides you with more than 150 different instruments with quite affordable commissions and incredibly high leverage rates. What’s also worth mentioning is that Exness comes with three high-powered trading platforms, all of which help you maximize your trading potential in the market.

In conclusion, it’s pretty safe to say that Exness is a legit and trustworthy broker and there’s nothing standing in your way to get started with it.

Top Online Forex Brokers

Recommended Brokers January 2021

-

1

Exness

Review

Visit site

Exness

Review

Visit site

-

2

FXTM

Review

Visit site

FXTM

Review

Visit site

-

3

Global Pri..

Review

Visit site

Global Pri..

Review

Visit site

-

4

Equiti

Review

Visit site

Equiti

Review

Visit site

-

5

XM

Review

Visit site

XM

Review

Visit site

-

6

AVA Trade

Review

Visit site

AVA Trade

Review

Visit site

-

7

FP Markets

Review

Visit site

FP Markets

Review

Visit site

-

8

SqueredFi..

Review

Visit site

SqueredFi..

Review

Visit site

-

9

IG

Review

Visit site

IG

Review

Visit site

-

10

Alpari

Review

Visit site

Alpari

Review

Visit site

Legal disclaime

Forex Trading on margin carries a high level of risk, and may not be suitable for all traders/investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Decisions to buy, sell, hold or trade in securities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of “Day Trading” involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks.

No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Opinions expressed at this web site www.usfxt.com are those of the individual authors and do not necessarily represent the opinion of usfxt or its management.

usfxt.com has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. usfxt.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on information contained on this site. Past performance is no indication or guarantee of future performance.

This Web site contains links to Web sites, which are not maintained by usfxt.com. Links to third-party Web sites are provided for your convenience and information only. Third-party Web sites are not under usfxt.com’s control and we are not responsible for the content or accuracy of those sites or the products or services offered on or through those sites. The inclusion of a link in this Web site does not imply usfxt.com endorsement of the third-party Web site.

usfxt.com is compensated by the brokers referred to on this site